Sba commercial real estate loan calculator

Please note loan terms and rates will vary. 50 of the total project costs come from the participating lender.

Need A Great Financial Tool In Your Tool Box We Ve Been Providing Smallbusiness Loans To Owners In The Inlandemp Small Business Loans Business Loans Empire

SBA 504 loans are generally used for real estate purchases according to Mike McGinley EVP of Small Business Banking at Live Oak Bank one of the most active SBA.

. Term 5 years or 10 years if desired Rate Interest rates are prime now at 325 275 maximum so current range for. 28 for small businesses facing maturing mortgages balloon payments. In addition to the down.

What is the maximum SBA 7 a loan amount. The most that you can borrow for your small business with an SBA 7 a loan is 5 million. You can use an SBA 504 loan to buy construct or improve commercial real estate or to purchase heavy equipment.

Talk to one of our SBA 504 loan experts to learn how you can take. Theyre typically about 05 to. In the world of.

SBA 504 Loan. What is SBA real estate loan down payment. Commercial Real Estate Loans.

SBA 7 a Commercial Property Loan. For certain energy projects the borrower can receive a 504 loan for up to 55 million. Simply enter information into all of the fields below.

Commercial Real Estate Calculator Based on Cash Flow If you are buying a business with option to purchase the real estate youll want to look at both options to determine what. Key terms of typical 7 a real estate SBA loans. Agency will begin accepting refinancing applications Feb.

The maximum loan amount for a 504 loan is 5 million. Rates and Fees Interest rates on commercial real estate loans tend to be higher than those for residential loans. The down payment requirement for an SBA commercial real estate loan is generally 20 of the purchase price.

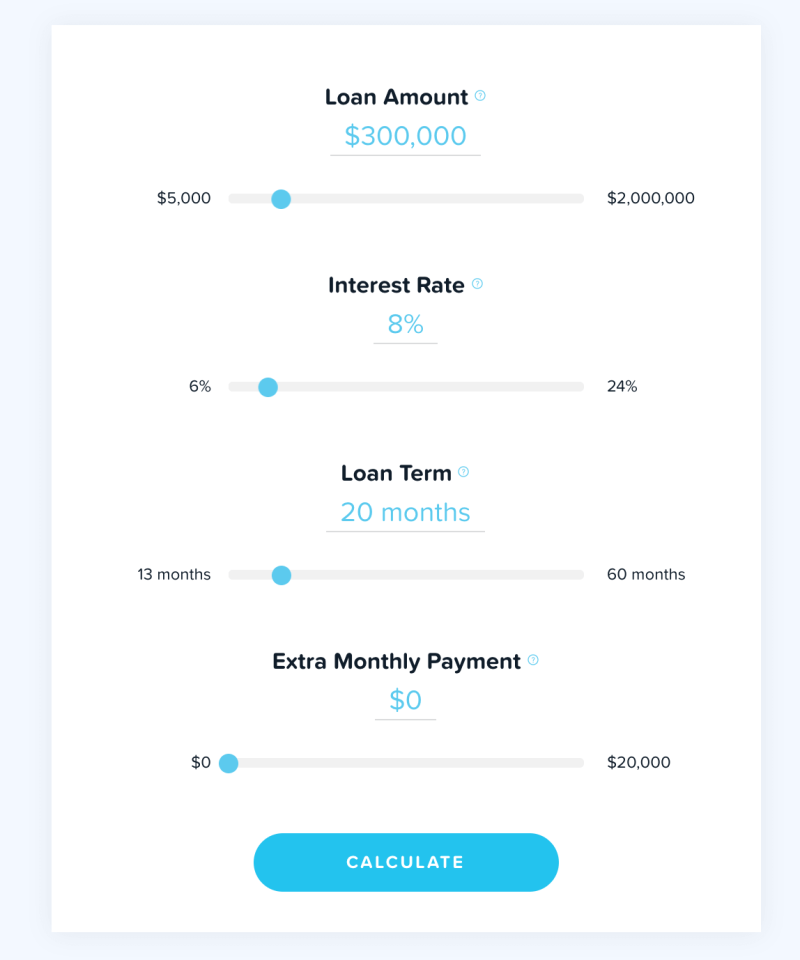

A commercial loan calculator uses some basic information about your loan to estimate the true cost of your loan including both the principle your loan amount and interest. The 504CDC loan program was created by the SBA in order enable businesses to complete projects much larger than what they would be able to accomplish with other loans. If you borrow the maximum the SBA will be.

SBA 504 Loan Calculator Owning is within reach. SBA Business Loan Calculator. Buy Commercial Real Estate With SBACDC Loans.

Overview SBA 504 commercial mortgage loans are made to companies for the purpose of acquiring and sometimes refinancing owner occupied commercial real estate. If you have further. Commercial Real Estate Loan Calculator Share Explore commercial real estate financing options View products For account maintenance 1-800-225-5935 Terms for credit products are subject.

Down Payment While most traditional commercial loans require a 20-40 down. Estimate payments in 10 secs Business Loan Calculator This tool is designed to provide you an estimate. If you have questions please see our FAQ section.

CDCs are certified and regulated by the SBA. Small businesses facing. Loan Calculator Calculate your estimated monthly payment.

While businesses must meet strict criteria to qualify many small businesses -- including many real estate businesses -- are eligible for SBA 7 a loans. Borrowers of 504 loans contribute a further. Through the 504 Loan 40 of the total project costs must come from the SBA.

Building Acquisition ImprovementsOther SBACDC Fees 24000 Total Project Cost 2024000 Your Information Project Region ZIP.

Own Commercialrealestate Need To Do Some Tenant Improvements Consider Using The Fixed Rate Sba504loan To Finance You Small Business Loans Sba Loans Empire

The Small Business Administration Sba Has A Number Of Loan Programs Designed Specificall Small Business Finance Small Business Loans Small Business Resources

Cash Suvidha Offers Small Business Loan At Competitive Rate Of Interest Businessloan Applyonline Fastapproval Small Business Loans Business Loans Business

Commercial Loans Commercial Loans Underwriting Commercial Lending

Sba Loan Calculator Estimate Payments Lendingtree

Ready To Start A Franchise Smallbusiness We D Love To Talk To You About 10 Down Finan Dentist Marketing Ideas Small Business Loans How To Introduce Yourself

Pin On Business Loans

There S A Wake Up Call Coming In The Form Of Rising Interest Rates However This Doesn T Have To Impede Your Decision To Purc Interest Rates Investing Rate

Interestrates Are Rising Your Business Needs Capital To Grow In 2018 July Rates For An Sba504loan Were Post Small Business Loans Business Loans Sba Loans

Sba 504 Pace Flex Pace Dakota Business Lending

Five Ways To Save For A Home Loan Visual Ly Home Loans Loan Home Improvement Loans

Not Buying Commercialrealestate With An Adjustable Rate Mortgage Just Makes Sense We Re Small Business Loans Small Business Commercial Real Estate Broker

Easy Commercial Mortgage Payment Calculator Lendio

Sba 7 A Loan Borrower Qualifications Sba7a Loans Commercial Loans The Borrowers Loan

Pre Approval For Mortgage Edmonton Refinance Mortgage Preapproved Mortgage Mortgage

Sba 504 Commercial Real Estate Loans Explained In 5 Minutes

Sba 504 Commercial Real Estate Loans Explained In 5 Minutes